|

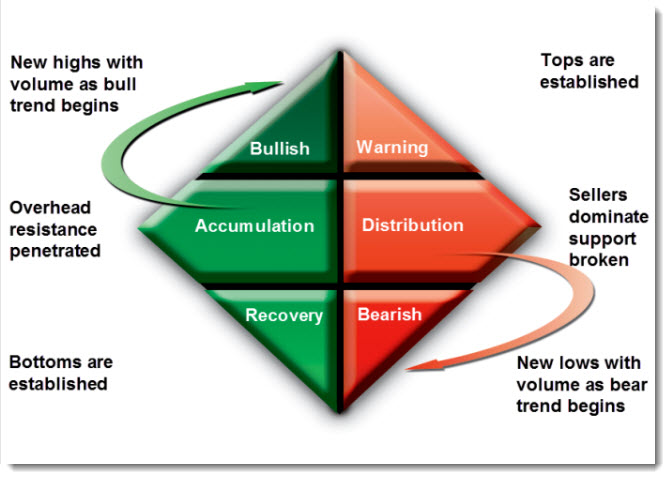

Diamond Analysis:

The Foundation of TRENDadvisor’s Winning System

According to Chuck Dukas, there is a clear distinction between price movements; and, with the advantage of modern day tools, he created a combination of technical indicators that form his TRENDadvisor Diamond.

The “Buy Side” and “Sell Side” of the Diamond highlight the technical traits found when demand dominates the action of buyers and conversely when the characteristics of supply overwhelm and the sellers take control of the action.

By establishing specific criteria that define each phase, trends are broken into separate components. Each phase describes a distinct price movement. The forces of buyers and sellers play out in the charts, thus allowing TRENDadvisor’s algorithm to profitably quantify supply and demand.

TRENDadvisor then takes the results and includes an analysis in a methodology and plan.

Reading the MarketPhase - The MarketPhase comprises of 6 phases of trend. There are 3 on the Buy-Side and 3 on the Sell-Side.

[ Home ]

|

Important Risk Information

An investment in financial instruments involves risks, including the possible loss of principal. The rate of return will vary and the principal value of an investment will fluctuate. Shares, if redeemed, may be worth more or less than their original cost. Asset allocation does not assure a profit or protect against down markets.

The stocks of smaller companies may be subject to above-average market-price fluctuations. There are specific risks associated with international investing, such as currency fluctuations, foreign taxation, differences in financial reporting practices, and rapid changes in political and economic conditions. Real estate investments may be subject to specific risks, such as risks related to general and local economic conditions and risks related to individual properties. Fixed income securities are subject to interest rate risk, prepayment risk and market risk. An investment in financial instruments involves risks, including the possible loss of principal. Hypothetical performance does not guarantee future results and the investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than performance quoted.

Not FDIC Insured * May Lose Value * Not Bank Guaranteed.

|

|

|

|

|